New Guidance for Vacate Notices on CARES Act Covered Properties

The federal CARES Act which went into effect during the COVID emergency period requires housing providers to give tenants a minimum of 30-days’ notice to vacate any properties that benefit from federal programs such as rental assistance and/or federally insured mortgage loans.

Several RHAWA forms were revised as of 12/13/2023 based on the outcome of Sherwood Auburn v. Pinzon, a case related to a tenant receiving two notices to pay or vacate with conflicting dates: A standard 14-day notice and a separate 30-day notice to comply with the CARES Act. Based on the outcome of the case, and how different courts interpreted it, RHAWA decided to offer separate, standalone 30-day notice forms for all notices that end the tenancy with less than 30 days, not just the 14-day Pay or Vacate notice.

• Notice to Quit (Two form versions: 3-day or 30-day notice)

• Notice to Comply or Vacate (Two form versions: 10-day or 30-day notice)

• Notice to Pay Rent or Vacate Premises (Two form versions: 14-Day and 30-Day)

• Notice to End Tenancy (Note added to 20-day causes on single End of Tenancy form)

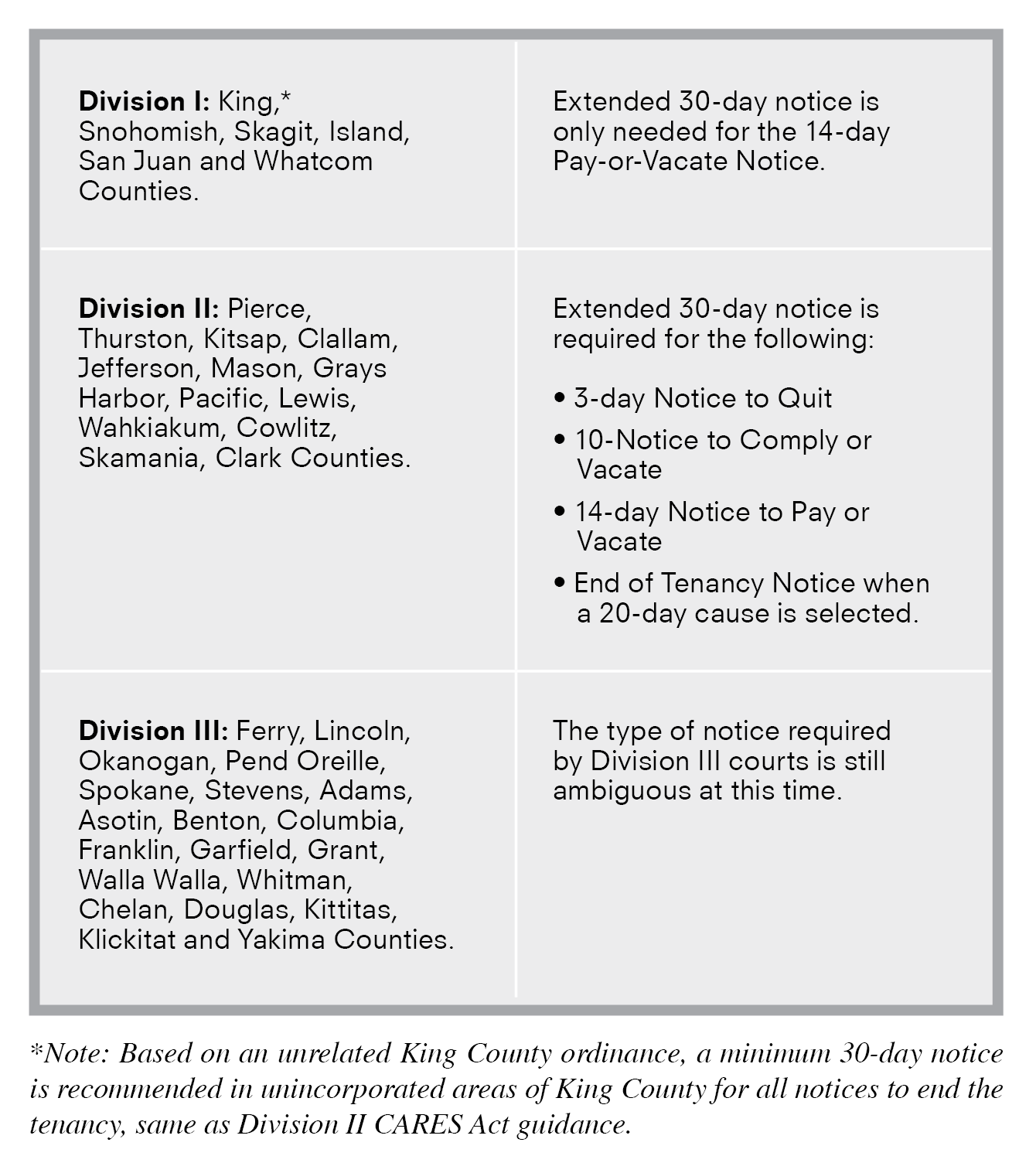

Washington courts in different counties have continued to interpret the application of the CARES Act 30-day notice rule differently. Some apply it to only the Pay or Vacate notice and others apply it to all notices that end tenancy. On February 26, 2024, Division I of the Court of Appeals released an opinion in KCHA v. Knight which means that in that division, the CARES Act requirement for 30-day minimum periods for pre-litigation notices only applies to non-payment of rent. Counties in Division II have been requiring a 30-day notice for all notices to end the tenancy. As of now, the type of notice required across Division III is ambiguous and may vary from county to county.

Washington courts in different counties have continued to interpret the application of the CARES Act 30-day notice rule differently. Some apply it to only the Pay or Vacate notice and others apply it to all notices that end tenancy. On February 26, 2024, Division I of the Court of Appeals released an opinion in KCHA v. Knight which means that in that division, the CARES Act requirement for 30-day minimum periods for pre-litigation notices only applies to non-payment of rent. Counties in Division II have been requiring a 30-day notice for all notices to end the tenancy. As of now, the type of notice required across Division III is ambiguous and may vary from county to county.

What is a CARES Act-covered property?

There are two reasons a property may be covered by the CARES Act: either (1) the property participates in a federal housing program or (2) the loan on the property is federally backed.

In general, almost all income-based rental programs trigger coverage, including:

• Public housing

• Section 8 Housing Choice Voucher program

• Section 8 project-based housing

• Section 202 housing for the elderly

• Section 811 housing for people with disabilities

• Section 236 multifamily rental housing

• Section 221(d)(3) Below Market Interest Rate (“BMIR”) housing

• HOME

• Housing Opportunities for Persons with AIDS (“HOPWA”)

• McKinney-Vento Act homelessness programs

• Section 515 Rural Rental Housing

• Section 514 and 516 Farm Labor Housing

• Section 533 Housing Preservation Grants

• Section 538 multifamily rental housing

• Low-Income Housing Tax Credit (“LIHTC”) / Section 42

Properties with federally-backed loans include any property with a federal loan guarantee (e.g. VA loans), and any property where the loan is held by Fannie Mae, Freddy Mac, or any other federal program. Many properties with conventional loans originated by banks and mortgage companies are sold to federal programs even if your loan servicer does not change. See Freddie Mac Loan Lookup.

Properties with federally-backed loans include any property with a federal loan guarantee (e.g. VA loans), and any property where the loan is held by Fannie Mae, Freddy Mac, or any other federal program. Many properties with conventional loans originated by banks and mortgage companies are sold to federal programs even if your loan servicer does not change. See Freddie Mac Loan Lookup.

This guidance on using the 30-day notice period to end tenancy is included on all RHAWA forms pages containing notices to end of tenancy. It is also found in our Support Center at rhawa.org/support-center.