Report Your Ownership of an LLC Before January 1st 2025!

You may or may not have heard that there are new federal reporting requirements involved with owning a Limited Liability Company (LLC) that you must comply with. Many of our members choose to use an LLC in order to protect their assets and in this case it is crucial that you report your ownership of this LLC to the federal government. This reporting must be completed by the end of the year. If you fail to register by the end of the year you will incur significant fines.

RHAWA wants to make this process as easy as possible for our members to complete. This article will detail some of the key steps in this process as well as provide images of the website where you register in order to lead you through this process.

It should not take up too much of your time to complete this process, so it is best to

address this filing requirement right away.

You will need:

• Information regarding your LLC and its beneficiaries

• Valid forms of identification for both yourself and for beneficiaries of your LLC

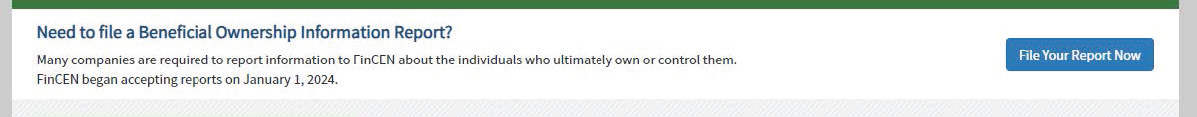

Step 1: Go to fincen.gov

Step 2: Click on the “File Your Report Now” button which can be found right under the green banner and is depicted below.

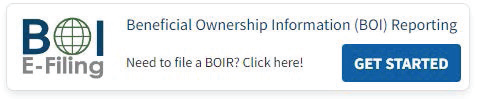

Step 3: Click on “Get Started” under Beneficial Ownership Information (BOI) Reporting. Depicted below.

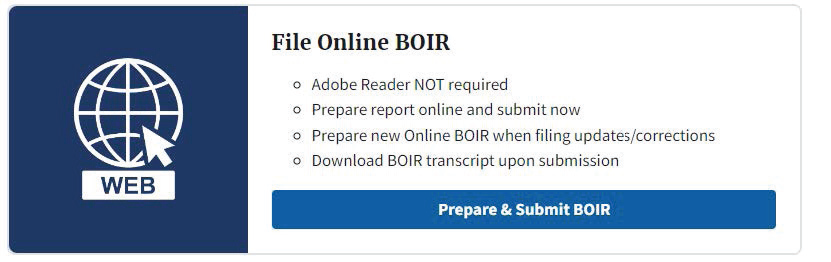

Step 4: You can either file a pdf version of this information or you can submit the

information digitally. RHAWA recommends submitting this information digitally

since a digital filing does not require any printing or scanning to complete. The information

you would submit with a pdf version is the same as the information you

are submitting digitally.

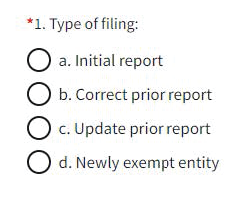

Step 5: It is likely that this is your first time accessing the website. If this is the case,

select “Initial report” from the options depicted below.

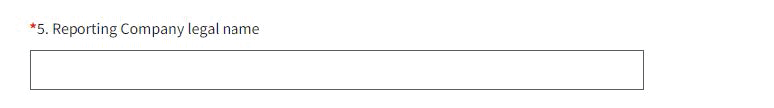

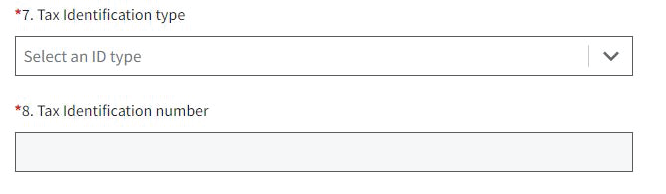

Step 6: Continue to fill out the required information as prompted by the website. You will see a red asterisk next to the required information. Examples of the information required are depicted below.

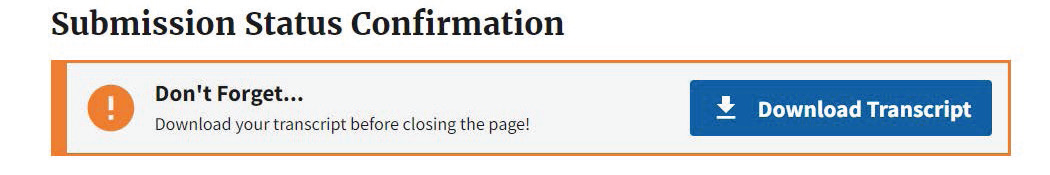

Step 7: If you gathered all your relevant information before beginning this process there should not be any surprises with the information that is requested. Once you have filled in all the required information, you will be brought to a completion page that will prompt you to download the transcript of this filing. Make sure to download this transcript for your records before closing the page.

Step 8: Congratulations! You have now properly registered your LLC with the Fin-CEN database.

Rest easy knowing that you will not encounter significant fines from the federal government for failing to register your LLC with FinCen. If you have any questions about this process, feel free to reach out to RHAWA staff. Keep in mind though, we are not the federal government and can likely only answer procedural questions about how to submit your information.

Thank you for taking the time out of your day to properly report your LLC ownership and keep yourself in line with federal reporting requirements.