Seattle Housing Providers Face MILLIONS IN UNPAID RENT

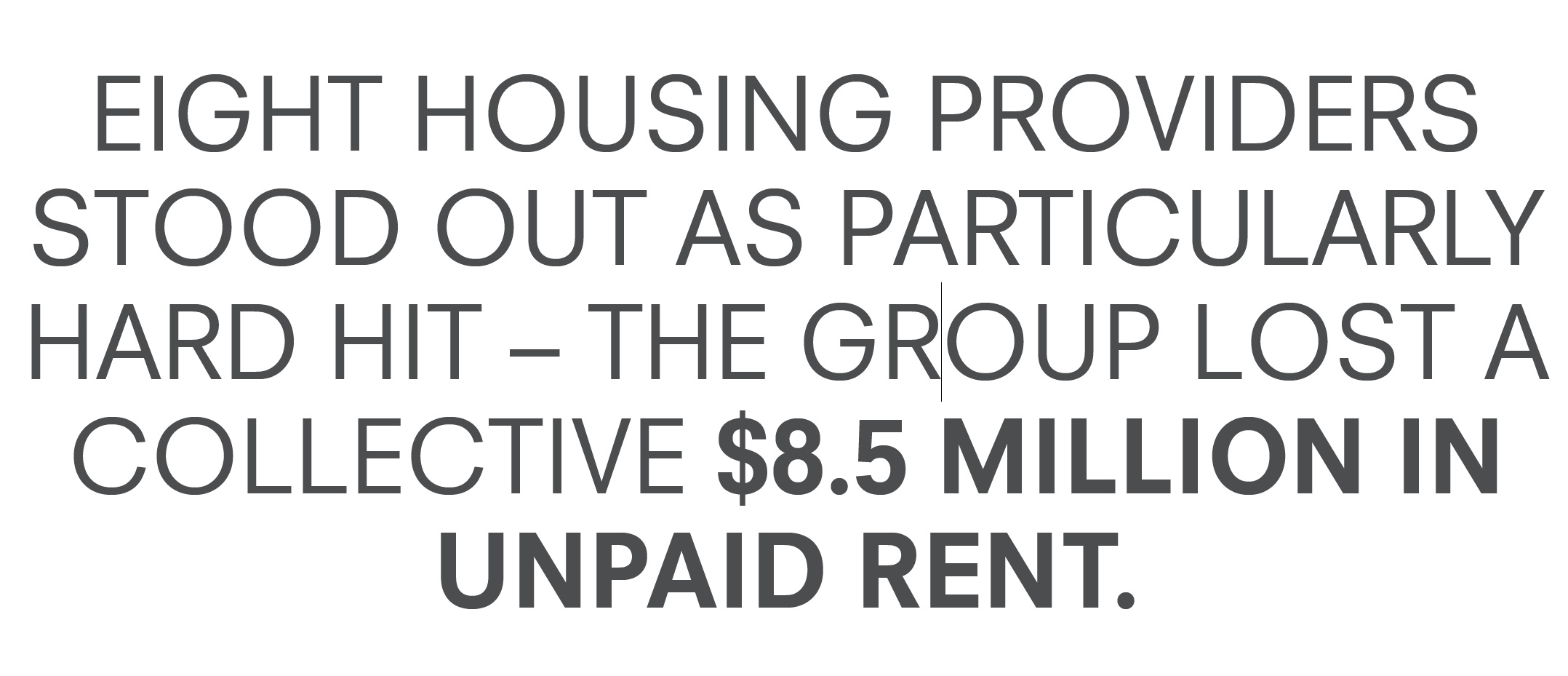

Affordable, subsidized housing in Seattle is in crisis. Several months ago, the City of Seattle announced $14 million in one-time funding intended to stabilize affordable housing providers. The Office of Housing received 24 applications requesting roughly $22 million. These 24 housing providers own and manage 10,200 affordable housing units across the city, and a public records request for their applications reveals just how dire the future of affordable housing in Seattle is.

Affordable, subsidized housing in Seattle is in crisis. Several months ago, the City of Seattle announced $14 million in one-time funding intended to stabilize affordable housing providers. The Office of Housing received 24 applications requesting roughly $22 million. These 24 housing providers own and manage 10,200 affordable housing units across the city, and a public records request for their applications reveals just how dire the future of affordable housing in Seattle is.

Every applicant described a similar set of grievances contributing to their unsustainable financial position. Many are on the brink of closure. The Seattle Times described the applications as “a collective cry for help.”

“Our agency does not have the funds to continue at this pace,” wrote Catholic Housing Services, who faces $517,000 in unpaid rent across only 260 residents. The housing provider cites “increasing costs of cleaning up after drug contamination from smoking methamphetamine and fentanyl in units,” as just one reason their insurance rates have risen 300% in the last five years.

The applications share a common theme of crushing levels of unpaid rent despite their residents’ ability to pay. Bellwether Housing, for example, secured $3 million in rental assistance for their residents between 2022 and 2023 but still wrote off $1.7 million in outstanding rent during that same time period. Alluding to a significant driver of the affordable housing crisis, the Bellwether application states that “major contributing factors to these cost increases are the serious behavioral health issues and criminal activity in and around our buildings.”

Community Roots Housing also secured $3 million in rental assistance for their tenants over the last three years, which they say, “has not resulted in meaningful change to our collections rate.” Their application describes a meth lab in one unit and another unit “overrun with nonresident individuals dealing in arms, methamphetamine, and fentanyl.” The organization says, “It took months to remove them from the premises due to local eviction restrictions,”while surrounding families in the building were “forced to endure escalating threats to their safety to remain housed.”

Chief Seattle Club faces $207,904 in unpaid rent. Their tenants “aren’t used to living indoors, so treat their units like a campsite.” One resident started a lithium battery fire in his unit while soldering stolen Lime scooter batteries together. Another resident regularly floods his unit while running cold water over the open sores on his legs for hours at a time. The organization’s request for funding includes money to cover a “janitorial contract to clean Mr. C’s unit twice a week” because he “spreads fecal matter on the walls.”

The challenges mount. Suicides, fatal overdoses, property destruction, families vacating due to safety concerns. One man set the community room couches on fire and then raped an outside guest experiencing homelessness. Another non-resident moved into a rooftop maintenance room and changed the locks.

Downtown Emergency Services Center (DESC) says their tenants “believe it is futile even to attempt paying back rent,” and GMD Developments says their tenants assume “they can probably live for at least a year, rent free, regardless of their ability to pay.” Many explicitly cite their inability to use eviction, even the threat of eviction, as a tool to compel tenants to pay their rent thanks to Seattle’s policies. Without that tool, “we will go bankrupt and have to return these properties to the lenders who may foreclose,” GMD says.

One of the most harmful policies, many of the housing providers note, was the pandemic-era eviction moratorium, which prevented tenants from being evicted for nonpayment of rent for months on end. Seattle’s affordable housing providers are still suffering from the consequences of this policy. Their experience parallels that of other providers in cities across the nation who suffer from disastrous eviction moratoriums. In Washington D.C., lawmakers are voting to roll back the eviction protections put in place in 2020, as the region’s affordable housing providers buckle under $100 million in unpaid rent.

Seattle’s application for stabilization funding asked each housing provider to explain how they incentivize rental payments and how they would use the funding for “new or innovative strategies or incentives.” Many of the providers describe their use of gift cards, raffles, gift baskets, “rent holidays,” lotteries, parties, snacks, and BOGO promos. Plymouth Housing spent $36,000 on such incentives, deeming the cost to be small relative to the $700,000 in unpaid rent Plymouth is facing. But the city’s focus on incentives reads like a slap in the face alongside the housing provider’s descriptions of high acuity, high-risk tenants whose negative impact on the community is compounded by Seattle’s policies.

The behavior of a few has an immense impact on many. What if the couches set on fire had burned down housing units, or worse, killed someone? The neighbor’s weapons and gun trade forced families to live in fear. Fears have also become realities. Last month, the Seattle Times reported the second homicide in nine months inside one DESC supportive housing building. Steve Eden was stabbed more than 20 times by the suspect, a fellow resident. While the majority of tenants are not soldering scooter batteries in their unit or the perpetrators of violent crime, the aggregate conditions created by a few impact entire communities and deprive them of their right to the quiet enjoyment of their homes.

While Seattle is in critical need of more affordable housing, the existing affordable housing is collapsing in a storm of unpaid rent following a years-long moratorium, backlogged eviction courts, and a fentanyl crisis worsened by decriminalization. Prizes and parties will not address root causes, and the city’s affordable housing funding only tosses a few lifelines to those drowning in turbulent waters. Until action is taken to calm the storm by reforming landlord-tenant laws and interrupting a deadly drug market, the affordable housing crisis will only get worse.

Caitlyn (Axe) McKenney is a research fellow and program coordinator for Discovery Institute’s Center on Wealth & Poverty. Her work has centered on government fiscal accountability, political rhetoric, and addiction with a focus on human dignity ethics. The Discovery Institute is a public policy think tank advancing a culture of purpose, creativity, and innovation. Learn more at discovery.org.