THE STATE OF THE MULTIFAMILY MARKET IN SEATTLE

The multifamily real estate market in the Seattle area is undergoing significant changes, driven by shifting economic factors, regulatory landscapes, and investment dynamics. This article highlights the key trends and projections shaping apartment sales and investments, as discussed in our 2024 Multifamily Market Update presentation at TRENDS, PNW Property & Innovations Trends Conference at the Seattle Convention Center in December 2024.

The multifamily real estate market in the Seattle area is undergoing significant changes, driven by shifting economic factors, regulatory landscapes, and investment dynamics. This article highlights the key trends and projections shaping apartment sales and investments, as discussed in our 2024 Multifamily Market Update presentation at TRENDS, PNW Property & Innovations Trends Conference at the Seattle Convention Center in December 2024.

ECONOMIC DRIVERS AND DEMAND

Seattle continues to be one of the strongest-performing metropolitan economies in the U.S., bolstered by its top GDP ranking. Year-over-year job and population growth remain central to the region's sustained demand for housing. Despite broader economic challenges, the region’s diverse employment sectors provide a stable foundation for long-term housing needs.

INTEREST RATE CHALLENGES

Higher interest rates have reshaped the financing environment. Since the Federal Reserve's rate hikes began in earnest in 2022, borrowing costs have increased significantly, impacting investor returns and financing structures. Forward-looking indicators suggest stabilization could occur soon, creating potential for renewed investor confidence.

DEVELOPMENT TRENDS AND VACANCY RATES

New construction continues to be a critical factor in balancing supply and demand. However, net deliveries have slowed in 2024, resulting in marginal decreases in vacancy rates across various submarkets.

RENTAL MARKET INSIGHTS

Rental rates in the tri-county area (King, Snohomish, and Pierce Counties) have seen mixed trends. Urban core properties face higher rent growth compared to suburban areas as back-in-office policies proliferate. See the below table for vacancy rates, rent averages, and projected rent growth by neighborhood.

INVESTMENT METRICS AND VALUATIONS

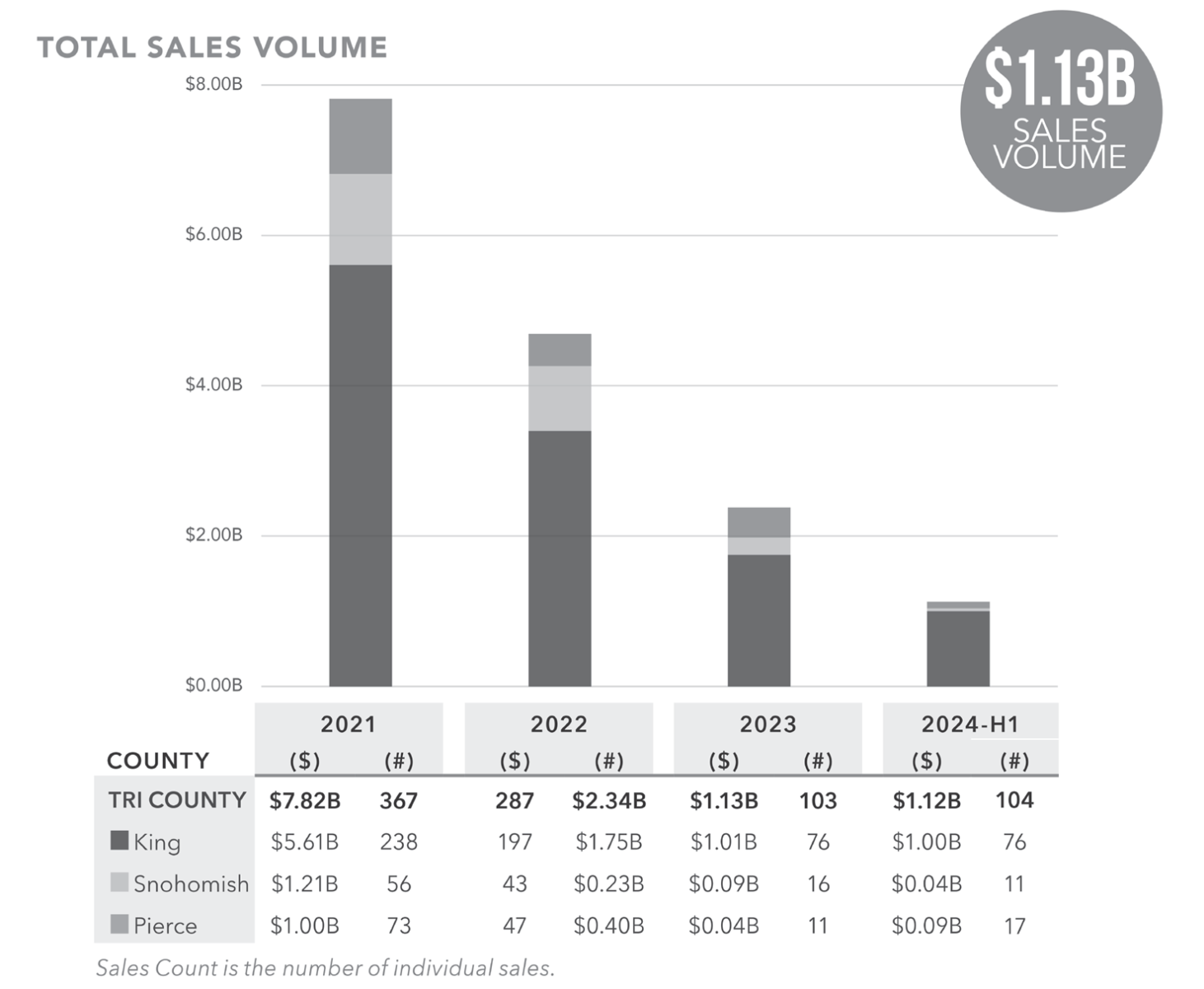

The total sales volume of multifamily assets has seen a decline due to rising interest rates and a widened gap between seller and buyer expectations. Despite short-term value adjustments, Seattle's long-term investment outlook remains strong, supported by the region’s resilience and potential for future rent growth. Sources: Public Record, Commercial Broker’s Association, CoStar and Lee & Associates primary research.

Sources: Public Record, Commercial Broker’s Association, CoStar and Lee & Associates primary research.

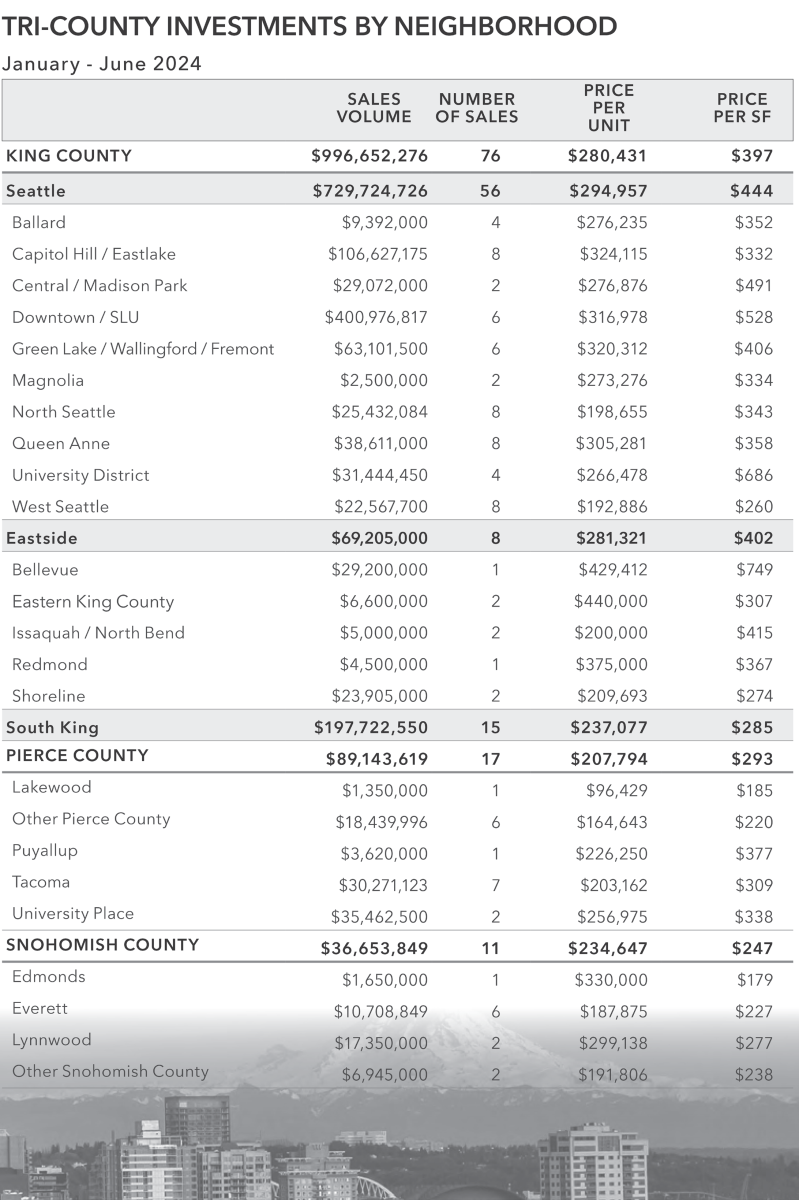

See the below table for a detailed analysis of value metrics in the Tri-County area, broken down by neighborhood. Sources: Public Record, Commercial Broker’s Association, CoStar and Lee & Associates primary research.

Sources: Public Record, Commercial Broker’s Association, CoStar and Lee & Associates primary research.

REGULATORY ENVIRONMENT

Seattle housing providers face a complex regulatory framework. Property owners must navigate these regulations carefully to avoid legal pitfalls, particularly in eviction processes and lease agreements. The 2025 Legislative session promises to be an exciting one. Support the RHAWA advocacy efforts to protect the important service housing providers deliver by making sure your voice is heard during this legislative session.

OUTLOOK AND CLOSING THOUGHTS

In the near term, the multifamily market in Seattle will remain sensitive to interest rate fluctuations and policy changes. However, the region's strong fundamentals—job growth, population trends, and sustained demand—indicate a positive trajectory for long-term investors. To navigate this market effectively, stakeholders should focus on financial performance and monitor emerging trends closely. As we move into 2025, maintaining adaptability and seeking expert guidance will be key to leveraging opportunities in this evolving landscape.

Lee & Associates offers an array of real estate services tailored to meet the needs of the company’s clients, including commercial real estate brokerage, integrated services, and construction services. Established in 1979, Lee & Associates is now an international firm with offices throughout the United States and Canada. Our professionals regularly collaborate to make sure they are providing their clients with the most advanced, up-to-date market technology and information. For the latest news from Lee & Associates, visit lee-associates.com or follow us on Facebook, LinkedIn, Twitter, and Link, our company blog.